The fallout of this crisis has been the broad expansion of people living in dire straits. This morning the NY Times published a report about poverty in suburban America. Once seen as a safe haven from many of society’s problems, it seems suburbia has found itself in the same situation that the rest of the country has.

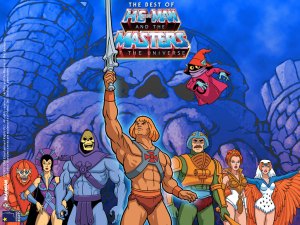

It’s easy to feel a certain level of sympathy for folks that have found themselves caught in the crossfire of the Masters of the Universe’s failed experiment in laissez-faire capitalism. The dismantling of the protections brought by Glass-Stegall in the wake of the first Great Depression as well as the weak enforcement of regulations by the Bush Administration led the way to this nightmare of deregulation that has ultimately hurt everyone worldwide.

So while Congress passed some regulatory reform, it still can’t seem to get its head out of its hind-quarters on the actual root of the problem, (money men run amuck), the nation, and other industrialized countries worldwide, not to mention those who rely on our consumption to stay afloat, continue to suffer.

But there’s suffering and then there’s suffering. While the majority of the country has been suffering from increasing income inequality since the late 1960’s, some have figured out a way to game the system to produce quick, if not sustainable wealth. Today the Wall Street Journal chronicled one of those stories.

Meet the Siegel family. The once proud time-share magnate now finds their life in shambles, trying to make ends meet while owning a home of a mere 26,000 square feet after losing the 90,000 square foot home they were building that they appropriately called “Versailles”. They lost their private jet, and now have to suffer the indignity of flying First Class. I’m sure their personal struggles are far more dire than anything I could possibly imagine.

Give me a freakin’ break.

While its unfortunate that these folks have been caught up in the financial crisis, the fact that they are managing to survive in a home that is some 17 times the size of my humble abode (which again, is more than many Americans have and I’m incredibly thankful for it) is insult to injury. These folks don’t need pity, they need to be slapped back into reality. The world they live in is not Disneyworld, but Disneyworld on a drug induced, debt fueled, PCP like mania that is the very definition of what is wrong with the way our economy has “grown”.

As noted in the article:

It wasn’t always this way. For decades after World War II, the top-one-percenters were the most steady line on the income and wealth charts. They gained less during good times and lost less during contractions than the rest of America.

Suddenly, in 1982, the wealthiest broke away from the rest of the economy and formed their own virtual country. Their incomes began soaring higher during good times. The top 1% of earners more than doubled their share of national income, to 20% as of 2008. Looking at another measure, the richest 1% increased their share of wealth from just over 20% to more than 33%.

Those surges were often accompanied by mini-crashes, even though the direction over time was always up. A top 1% that had once been models of financial sobriety set off on a wild ride of economic binges.

Economic binges. Maybe comparing what’s going on in our country’s economy to a PCP high isn’t that far off the mark.

Over the past 30 years that I’ve been aware enough of what’s going on in this country to form an opinion, I’ve seen the idolization of obscene wealth take a nasty turn from building the country to building a series of feifdoms on a foundation of toothpicks and bubblegum. This is the problem, not middle class people who didn’t adjust fast enough to divest of their only asset (their home) before the latest in a series of bubbles burst. We have created a shadow economy that is in no way tied to real economic growth. In fact, the article notes that the “leveraging” these individuals engaged in was some 20 times more volatile than economic growth.

For the better part of the last 3 decades we’ve seen companies profit margins expand exponentially while median incomes have been largely flat. The standard of living for regular Americans hasn’t gotten better. If anything, its gotten worse, despite promises of the grand outcomes that would come with deregulation. Yet somehow, the American public just doesn’t see the connection.

This has to stop. It’s time to take a good hard look at ourselves and ask if this is what we want to be: burnt out and used up well before our prime, or something a bit more sustainable that will benefit not only the most ambitious, but also the people who get the stuff done day after day that no one else wants to do.

We’re sick, and its time we realize it. We need a 12 step program.

The first step is realizing you have a problem. I think the majority of Americans realize it, but realization alone doesn’t end addiction, action does. To end this addiction, we have to be more honest with ourselves than we might normally be comfortable with.

Failing this, we’ll likely be lulled to distraction like we were during the past 30 years, and find ourselves on the wrong side of a bubble once again. If we want the era of Bubblenomics to end, we’re going to have to stay vigilant, and not buy-in to the next quick fix that these so-called “financial experts” want to sell us.

Believe me, they’re always selling, but we don’t have to keep buying. In fact, if we don’t, the very law of supply and demand that guides these “Masters of the Universe” will force them to find something more sustainable to sell.

Its time for us to force their hand.